Analysis of Variance Using Excel

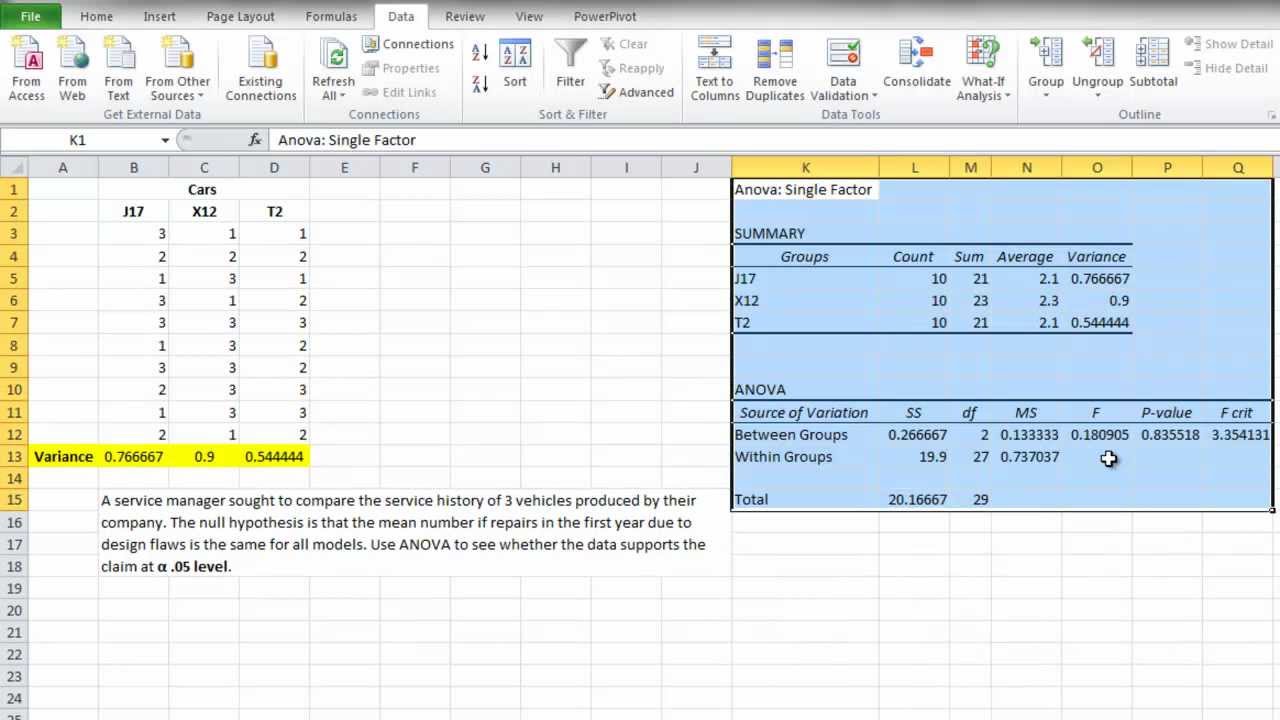

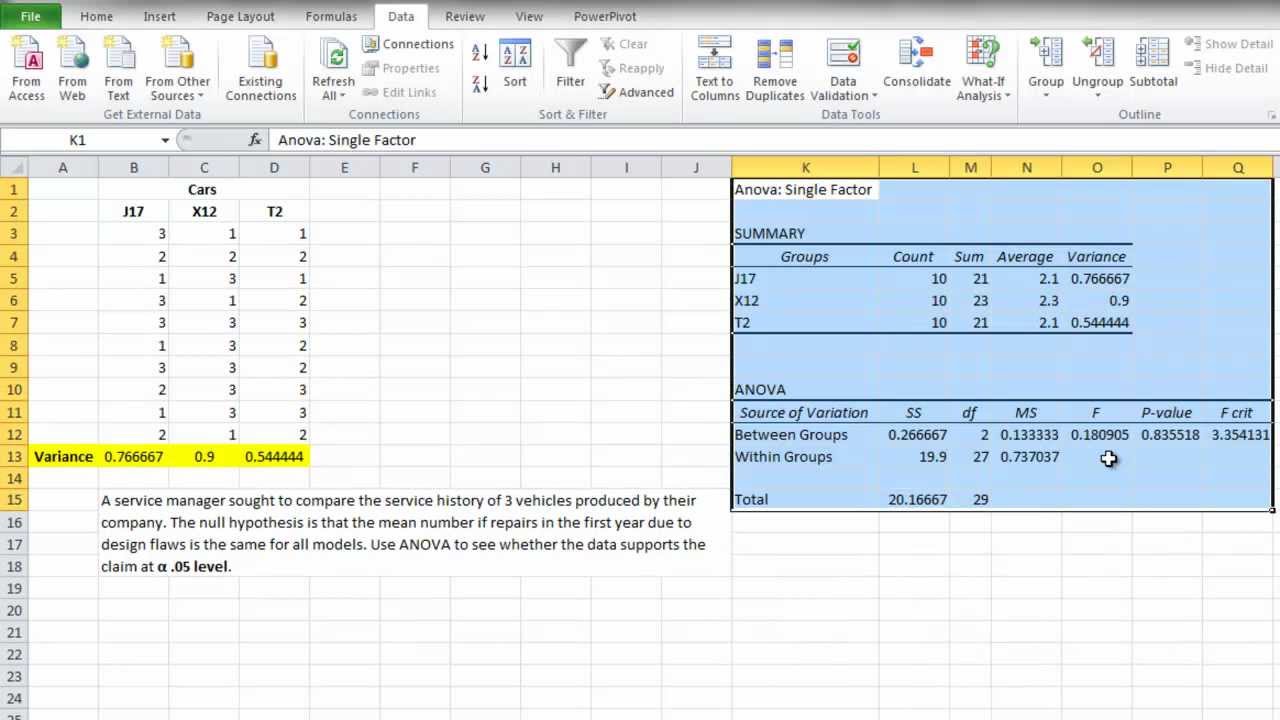

Next step Aging analysis using Excel Pivot tables. Analysis of variance ANOVA is a statistical technique that is used to check if the means of two or more groups are significantly different from each other.

Excel Variance Charts Making Awesome Actual Vs Target Or Budget Graphs How To Pakaccountants Com Excel Tutorials Excel Shortcuts Excel

20 Excel Table Tricks.

. But we can do this and much more using pivot tables. If the sample sizes are unequal then smaller differences in variances can invalidate the F-test. Firstly decide the base year and then note down the subject line items value in the base year.

This step only needs to be done once Go to TOOLS-ADD INS and select the Analysis Toolpaks and OK. The Solver is the data analysis tool that is used for solving problems. Anywhere in the worksheet lets say in column J and K give heading Range and Status.

Visit the AnalystSoft Web site and then follow the instructions on the download page. Learn how to assess models check assumptions and interpret results. Analysis of variance ANOVA is a tool used to partition the observed variance in a particular variable into components attributable to different sources of variation.

Without relation to the image the dependent variables may be k life. Most enterprise systems have some type of standard variable reporting capability but they often do not have the flexibility and functionality that spreadsheets provide. The descriptive statistics using EXCEL.

ANOVA checks the impact of one or more factors by comparing the means of different samples. Let X x i be any k 1 random vector. By the variance we simply mean the difference between these two values.

If for some reason when you use Data Analysis in the future and it is not there just download it again. Analysis of variance ANOVA and t-tests. Principles of the Analysis of Variance.

Debtors Aging report in Excel using Pivot tables. In this column we need to put if payment is Not due or 1-30 days etc. If youre using Excel 2007 click the Microsoft Office Button and then click Excel Options.

FIFO Costing in Excel. Principal component analysis is a statistical technique that is used to analyze the interrelationships among a large number of variables and to explain these variables in terms of a smaller number of variables called principal components with a minimum loss of information. Analysis of variance ANOVA uses the same conceptual framework as linear regression.

Budget variance Budgeted fixed overhead - Actual fixed overhead Budget variance 13000 - 11000 Budget variance 2000 The standard costing budget variance is positive favorable as the business spent 2000 less than it expected to in the original budget. The term meta-analysis was coined in 1976 by the statistician Gene V. Most variance analysis is performed on spreadsheets Excel using some type of template thats modified from period to period.

Next note down the value of the line item in the current year. If the value of the P is 0314 that is. A rule of thumb for balanced models is that if the ratio of the largest variance to smallest variance is less than 3 or 4 the F-test will be valid.

An ANOVA analysis of variance is used to determine whether or not there is a statistically significant difference between the means of three or more independent groups. As the month goes we collected the sales and production data in excel. Step-by-step example for using Excel to perform regression analysis.

In the Manage box select Excel Add-ins and then click Go. The Anova analysis tools provide different types of variance analysis. Once you plot these portfolios in a graph it would look something like this.

Usually higher R-squared values are better. Now the formula for trend analysis in terms of change in amount can. Meta-analysis refers to the analysis of analyses.

Once we have calculated the portfolio variance we can calculate the standard deviation or volatility of the portfolio by taking the square root the variance. The variance measures how far each number in the set is from the mean. It works just as a goal seeks within excel.

It can be downloaded. Whether you are performing statistical analysis using Excel 2010 or Excel 2013 you need to have a clear understanding of charts and pivot tables. ANCOVA stands for analysis of covariance To understand how an ANCOVA works it helps to first understand the ANOVA.

Using a data set chart we can observe what the linear relationship of the various data points or numbers is. Using Excels Residual Output. Profit and Loss Statement.

Using Standard Costing and Variance Analysis. Using some excel forecast formula we have forecasted some sales and unit production to date. Given the very ad hoc nature of variance.

Analysis of variance ANOVA is a statistical technique that is used to check if the means of two or. Make Aging analysis Reports. Steps to use data analysis tool in excel Example 1.

Now we want to create a report that shows the variance between actual and forecasted reports. This will add the analysis tools to your EXCEL. In our case it will be column F.

As a multivariate procedure it is used when there are two or more dependent variables and is often followed by significance tests involving individual dependent variables separately. We now define a k 1 vector Y y i. In statistics multivariate analysis of variance MANOVA is a procedure for comparing multivariate sample means.

10 ways to make variance charts. The term is a bit grand but it is precise and apt. The R-squared value of 0858 indicates that our model accounts for about 858 of the dependent variables variance.

The main difference comes from the nature of the. The tool that you should use depends on the number of factors and the number of samples that you have from the populations that you want to test. One can construct various portfolios by changing the capital allocation weights the stocks in the portfolio.

Add a new column give it a heading Status. Glass who stated my major interest currently is in what we have come to call the meta-analysis of research. In the above tutorial we used formula approach to get the job done.

For example suppose we want to know whether or not studying. The Trend Analysis Formula can be calculated by using the following steps. We will implement MANOVA in Excel using the RealStats Add-ins.

Much more attention needs to be paid to unequal variances than to non-normality of data. Having knowledge of the essential statistics for data analysis using Excel answers is a plus. The output will show the teams average value along with the variance values Pearson Correlations and much more.

This tool performs a simple analysis of variance on data for two or more samples. Although this led to him being widely recognized as the.

10 Ways To Make Excel Variance Reports And Charts How To Pakaccountants Com Excel Excel Shortcuts Excel Hacks

Variance Analysis In Excel Making Better Budget Vs Actual Charts Pakaccountants Com Microsoft Excel Tutorial Excel Tutorials Excel Budget

Anova Explained Excel 2010 Excel Anova Analysis

Variance Analysis In Excel Making Better Budget Vs Actual Charts Pakaccountants Com Microsoft Excel Tutorial Excel Tutorials Excel Budget

No comments for "Analysis of Variance Using Excel"

Post a Comment